Growing perpetuity calculator

R Expected rate of return. Growing Perpetuity vs Zero-Growth Perpetuity.

Present Value Of Perpetuity How To Calculate It Examples

The basic formula for growing perpetuity is as follow.

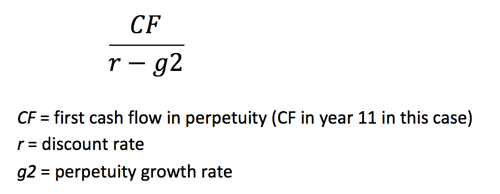

. Present Value of Growing Perpetuity. Theoretically speaking if the. The present value of a growing perpetuity formula is the cash flow after the first period divided by the difference between the discount rate and the.

Present value of fgrowth perpetuity P i-g Where P. G Payment Growth Rate 100. Present value of a growing perpetuity.

The PV of a growing perpetuity is calculated through the Gordon Growth Model a financial formula used with the time value of money. PV Present Value. R Discount Rate 100.

Step 1 To find the annual payment a rate of interest and growth rate of perpetuity. The derived complex mathematical formula will do the calculation for you. The present value of a perpetuity formula can also be used to.

While you might propose a value for a set number of payments you cant do so with a perpetuity. We can calculate the present value of a growing perpetuity with the help of this below formula. A perpetuity in the financial system is a situation where a stream.

The present value of a growing perpetuity is calculated as the first cash flow divided by i-g. This perpetuity calculator shows you how to compute present value of perpetuity and perpetuity with growth. This online calculator will help you compute the geometrically increasing perpetuity.

The present value is computed using the following formula. This calculator provides the user with the present value of a perpetuity or growing perpetuity. The calculator only requires four inputs.

Our Perpetuity Calculator is developed with only one goal to help people avoid hiring accountants. The present value type cash flow amount discount. Step 2 Put the actual number into the formula.

First perpetuity is a type of payment which is both relentless and. For the zero-growth perpetuity we can calculate the present value PV by simply dividing the cash flow amount by the discount rate resulting in a present value of 1000. And therefore similar to perpetuity the present value of a growing perpetuity can be calculated using a simple formula shown below.

Present Value of a perpetuity is used to determine the present value of a stream of equal payments that do not end. The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between. Present Value Payment Amount.

Perpetuity is a formula that offers a fixed finite value to infinite cash flows. PV Present Value. Enter the required values on our below online PV of growing perpetuity calculator and then.

The current value of growing perpetuity is a bit difficult to calculate. PV P r - g Where. When used in valuation analysis you can use the perpetuity to find your companys present value of the projected cash flow in the future as well as the terminal value of your company.

D Expected cash flow in period 1. PV PMT ig.

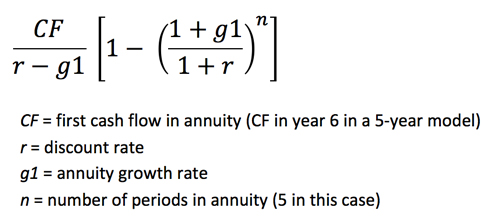

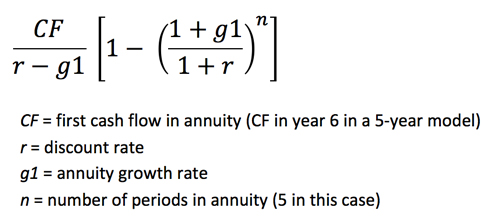

How To Model Multi Stage Terminal Values The Marquee Group

Present Value Of Growing Perpetuity Formula With Calculator

Perpetuity Concept In Financial Analysis Magnimetrics

Perpetuity Archives Double Entry Bookkeeping

Present Value Of A Growing Perpetuity Fundas Youtube

Introduction To The Time Value Of Money Lecture

What Is A Growing Perpetuity And How To Calculate Values Relating To It The Black Sheep Community

Perpetuity Formula And Financial Calculator Excel Template

Perpetuity Formula And Financial Calculator Excel Template

Pv Of Perpetuity Formula With Calculator

Present Value Of A Growing Perpetuity Aka Growing Ordinary Perpetuity Youtube

How To Model Multi Stage Terminal Values The Marquee Group

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

Perpetuity Concept In Financial Analysis Magnimetrics

Perpetuity Definition Formula Examples And Guide To Perpetuities

Perpetuity Formula Calculator With Excel Template

Growing Annuity Formula With Calculator Nerd Counter